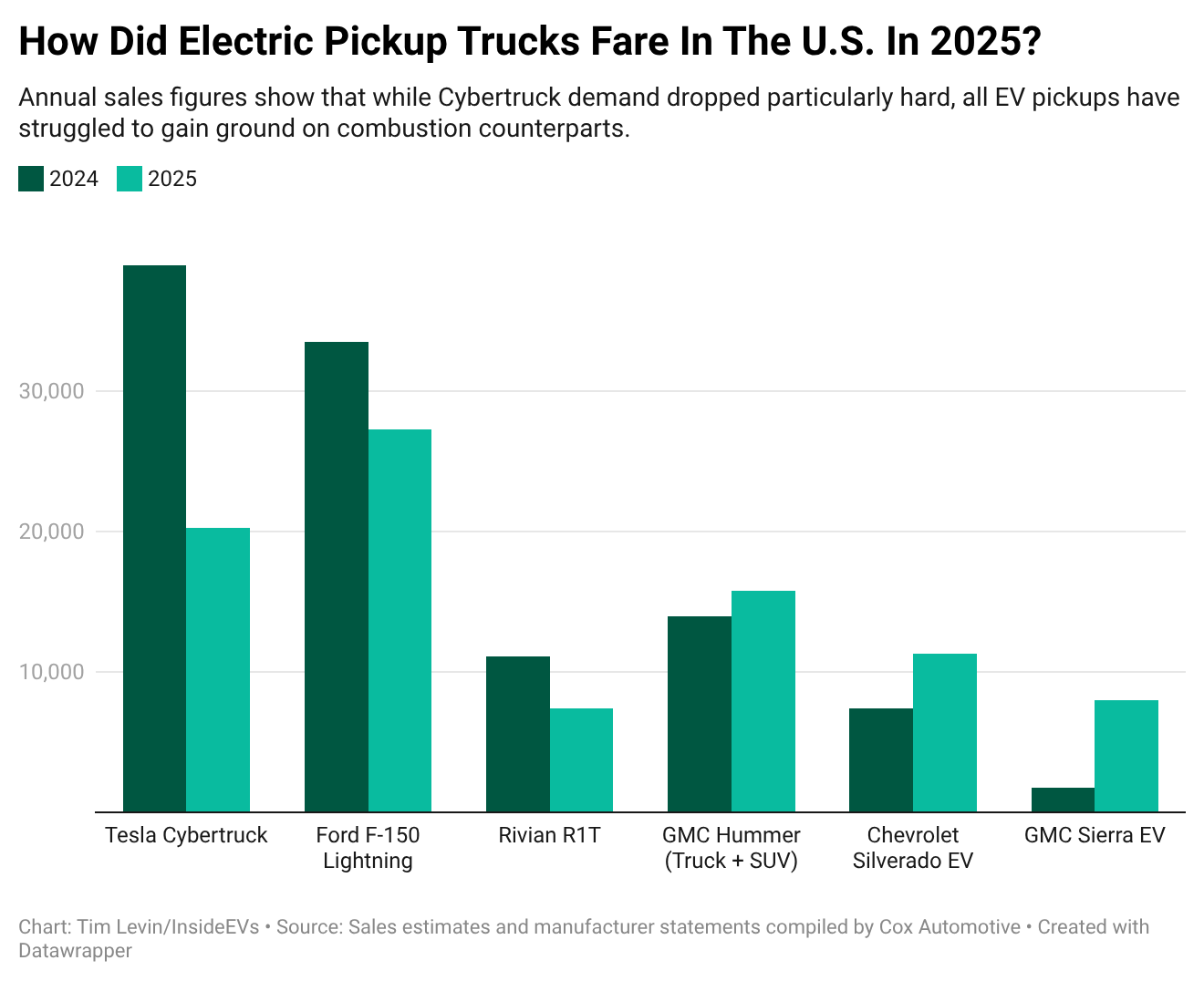

In a tumultuous year for the electric-vehicle market in the United States, the Tesla Cybertruck fared particularly poorly. Elon Musk’s angular pickup experienced the steepest drop in sales of any EV in the U.S. in 2025 on a volume basis, according to an InsideEVs analysis of Cox Automotive data.

Tesla sold close to 39,000 Cybertrucks during the truck’s first full year on the market in 2024, Cox estimates. Last year, sales were nearly cut in half, with the firm estimating that Americans bought some 20,200 Cybertrucks in 2025. The nearly 19,000-unit shortfall represented the largest sales drop of any electric model on sale in America, including those that were canceled partway through the year.

These EV models saw the largest year-over-year declines in sales volume in 2025.

Photo by: Tim Levin/InsideEVs

Unlike most other manufacturers, Tesla does not break out its deliveries by region or by individual model. So third-party estimates are the best proxy we have for sales.

To be sure, the polarizing truck was in part a victim of its own early success. It ended 2024 as America’s most popular electric pickup by a solid margin, capturing buyers with its unusual looks and genuinely forward-thinking elements like a steer-by-wire system. Because only a handful of EVs manage to notch annual sales of over 30,000 or 40,000 units in an increasingly crowded market, the Cybertruck had farther to fall than most battery-powered models. Most models sell somewhere between 2,000 and 20,000 examples per year.

The Tesla Cybertruck suffered from wider challenges facing electric pickups as well as brand issues at Tesla.

Photo by: InsideEVs

But it’s also clear that after an initial rush of buyers, demand for the Cybertruck—which Musk has called Tesla’s best product ever—has deteriorated quickly. The company says it has the capacity to produce over 125,000 Cybertrucks per year at its Texas factory, and Musk has floated 250,000 trucks as a target in the past. It all suggests that Tesla grossly overestimated consumer appetite for the rather expensive, stainless steel EV.

Tesla’s truck was far from the only EV to see declining sales in a tough year for America’s plug-in vehicle market.

Photo by: InsideEVs

It was far from the only model that struggled to keep up in 2025 as cornerstone policies driving EV sales, like the $7,500 clean-vehicle tax credit, vanished. Even before the policy whiplash, demand growth for EVs was softening as enthusiastic early adopters gave way to mainstream buyers looking for more practical, affordable options. In 2025, over two-dozen EV models experienced year-over-year sales declines, some steeper than others.

Kia EV6 sales slumped by 40%, from 21,715 units to 12,933. Cadillac delivered some 7,400 fewer Lyriq crossovers last year than it did the year prior. Tesla Model Y sales fell by around 15,000 units, Cox says, but that was only a 4% decline for America’s most popular EV by far. Ford’s E-Transit van sales sagged by 59% to around 5,200 units.

Some models bucked the trend, though. Chevrolet Equinox EV sales doubled to 57,945 units, making the small crossover America’s new favorite non-Tesla EV. (The Equinox EV was only on sale for part of 2024 however.) Honda Prologue sales jumped nearly 19% to over 39,000 units.

New entrants that weren’t on the scene in 2024—like the Cadillac Optiq, Hyundai Ioniq 9 and Jeep Wagoneer S—also helped balance out the poor performers. Battery-electric vehicle sales in the U.S. dipped by 2% to 1.28 million vehicles in 2025, according to a final tally by Cox. The overall light-duty vehicle market grew slightly.

The Cybertruck faced a particular set of challenges. Its love-it-or-hate-it styling has divided consumers since it was first revealed in 2019. Musk’s association with the Trump administration and far-right causes more broadly has repelled liberals—a core EV-buying group—from the Tesla brand. To some, the Cybertruck became more of a bold political statement than just a truck.

Electric pickup trucks have broadly failed to match the huge sales volumes of their gas-powered rivals.

Photo by: Tim Levin/InsideEVs

It also dealt with the same headwinds that have dogged big electric pickup trucks like the Ford F-150 Lightning and Chevrolet Silverado EV. EV trucks have largely failed to get off the ground in the U.S. due to the high cost of their large batteries as well as concerns around limited towing capability.

The Lightning, once hailed as the pickup that would take EVs mainstream, was canceled in December. Ram scrapped its own fully-electric pickup plans in favor of a “range-extended EV” version with a gas engine that supplements the battery. While General Motors and Rivian sell electric pickups in the U.S., none have reached nearly the kinds of sales volumes that America’s gas trucks achieve.

Despite the Cybertruck’s stumbles and a lineup-wide drop in sales, Tesla ended 2025 as America’s top EV player—as it has for many years. The automaker sold approximately 590,000 cars in the U.S. according to Cox, giving it a commanding 46% market share of the electric space. It proved more resilient to the post-tax-credit sales collapse in the fourth quarter as well. In the final three months of 2025, Cox says, Tesla’s share of EV sales rose to 59%.

Contact the author: [email protected]

We want your opinion!

What would you like to see on Insideevs.com?

Take our 3 minute survey.

– The InsideEVs team